David A. Altro’s “Keeping a bargain a bargain” was published in the January/February 2010 edition of CAmagazine. We invite you to read below as David constructs a case study exploring the complexities of purchasing a property in the U.S. during today’s unique economic situation.

See how in David’s scenario, several key factors (i.e., a strong Canadian dollar and a depressed real estate market) favour U.S. real estate purchases by Canadians. Oriented towards Chartered Accountants, the article provides an in-depth analysis of the cross border tax and estate planning implications of this kind of transaction.

Download the article here (PDF) , or read it below.

![]()

Keeping a Bargain a Bargain

US real estate is attractive, but a few tax and estate planning strategies can help you avoid tax and probate issues

With US sunbelt property values having decreased dramatically over the past few years and the Canadian dollar trading at reasonable levels, it isn’t surprising that a number of Canadians are contemplating purchasing a property stateside. To explore the crossborder estate and tax complexities of such a purchase, the following case study considers a Canadian resident couple planning to purchase a condo in Florida.

Brad and Angelina are married and are both Canadian citizens and residents. They have two children: Bonnie, 29, and Matt, 26, also Canadian citizens and residents. The couple plans to purchase property in Boca Raton, Fla., for US$1.5 million. They expect to close on the property with cash but plan to finance between 50% and 60% of the purchase price (between US$750,000 and US$1 million).

Brad’s life insurance policy has a face value of US$2 million; his total estate is worth about US$6.5 million (including a $2-million life insurance policy). Angelina’s estate is worth about US$8.5 million. Their total joint estate is worth US$15 million. They don’t own any shares or bonds of US companies and would like to lower their potential US estate tax liability.

Issues with holding property titles personally

Probate is the legal procedure required to transfer legal title to children or beneficiaries upon your death. As per Florida statutes, probate may cost up to approximately 3% of the value of the Florida estate (US$1.5 million) upon the date of death, which translates into approximately US$45,000 of probate fees and expenses based on the current value of the property. Of course, it is highly likely that the value of the property will have greatly appreciated at the time of death and that probate expenses would be significantly higher.

Other US real estate title ownership issues include an incapacity hearing and guardianship determination if you are deemed to be incapacitated. A guardianship proceeding is a legal proceeding under which a person who lacks the ability to manage certain functions of daily living is declared by a court to be incapacitated and loses the legal right to make certain decisions. The court must make a finding of incapacity then determine whether to appoint a guardian to exercise the decision-making rights that were removed. Guardianship proceedings re-quire legal representation and can be costly.

Since probate and guardianship procedures are also time consuming and freeze the estate, we would like to structure the couple’s estates so they avoid probate and guardianship procedures.

There are specific rules under the Internal Revenue Code and the US-Canada Tax Treaty regarding US estate tax applicability to a Canadian resident who dies owning US assets.

Those with less than US$60,000 worth of US domiciled assets avoid the whole US estate tax issue. Even where the US assets exceed US$60,000 on death, there may still be no US estate tax payable by applying the treaty as it provides that should the worldwide value of assets not exceed US$3.5 million (2009 rule, this exemption is subject to change under current code legislation and also pursuant to draft bills proposed to the Senate and Congress. At press time, a legislative clarification was expected before the end of the year) there will be no estate tax.

However, should the US assets exceed US$60,000 and the worldwide estate exceed US$3.5 million, there may be estate tax on death depending on the value and ratios of the US assets as the numerator and the worldwide assets as the denominator multiplied by the exemption, to determine the credit. The resulting credit is then subtracted against what would otherwise be the tax.

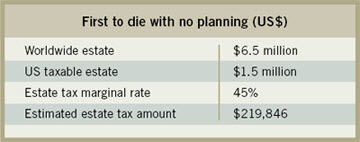

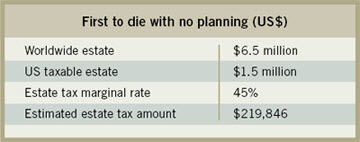

With no US estate planning, should Brad die first and in 2009, his estate faces a potential US estate tax liability of US$219,846 (see table above). This calculation is based on his worldwide estate of US$6.5 million in 2009 and his potential US$1.5-million ownership interest in the property. (Sec. 2040(a) of the code, the Contribution Rule, presumes that where husband and wife own jointly, the entire value of the property is included in the estate of the first to die.)

There are two ways to mitigate that tax if Angelina survives Brad. The first is a marital credit available under the code and the treaty. Brad’s asset basis is such that his estate tax would be eliminated. Upon the second spouse to die (assuming Angelina dies after Brad), her US estate tax liability will be US$410,220 (based on US$1.5-million value of the property and US$15-million worldwide estate), using the 2009 values and exemptions (although there is actually a credit when the second spouse dies shortly after the first).

If Angelina dies first, there will be a tax of US$42,000 even after applying the marital credit because of her higher worldwide estate. In such a case where the marital credit isn’t sufficient to eliminate the estate tax, a second approach would be for the surviving spouse to roll the US assets of the deceased spouse into a qualified domestic trust, which will form part of the crossborder trusts (CBT). In such case, the marital credit will not apply.

Potential strategies

Purchase of property and CBT

We recommend purchasing the property through two separate CBTs (one for Brad and one for Angelina). Each trust would own 50%. This would rebut the presumption of IRC Sec. 2040(a) contribution rule, which presumes that where husband and wife own property, the first to die paid for the property. Each spouse’s contribution would be the percent of the value used in each of their estates and not the entire purchase price.

CBTs are structured so that upon the death of the first spouse, the 50% value of the property does not get added to the surviving spouse’s half but stays inside the trust of the first to die so that only 50% of the property is in the estate of the second spouse to die. Upon second to die, the property in the trusts would be divided into two equal shares in the trusts for Bonnie and Matt, providing the children with creditor protection and marital asset protection if divorced.

With CBTs in place, probate expenses and procedures related to the property will be completely avoided in the US and Canada. Aside from reducing or eliminating US estate taxes while preserving foreign credits in Canada under the US-Canada Tax treaty, a CBT structure also protects beneficiaries against their creditors and/or a beneficiary’s divorcing spouse from realizing rights to the property in the CBT.

Lastly, CBT assets are not generally subject to the jurisdiction of the guardianship court if either spouse were to become mentally incapacitated. Rather than going through a guardianship proceeding, a CBT enables the successor trustee to step in to manage assets without court intervention.

In each spouse’s respective CBT, they are the grantor, trustee and beneficiary, while the spouse serves as a co-trustee. No one else is involved in the CBT while the grantor is alive. There are no annual filing requirements either to the IRS or Canada Revenue Agency (CRA) unless there is rental income. Nor will there be any requirement for an accountant or attorney for annual administration or maintenance fees. Once established for the first property, the trust structure is ready to accept any additional property purchased in Florida without further amendments or expense. Should the couple no longer own Florida properties, no dissolution, wind-up procedure, or legal or accounting services are required. The CBT is basically maintenance free and revocable should they wish to amend or delete any clauses.

Furthermore, should they ever sell the property, the sale proceeds would flow to the individual as opposed to the trust.

With regard to US estate tax liability, transferring a US property ownership interest into separate CBTs means that upon death, the deceased’s estates will not be subject to the full value of the property for estate tax purposes.

Valuation discounts

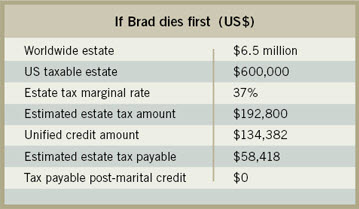

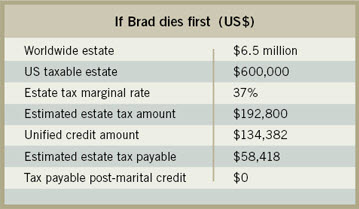

Each CBT will now be able to apply the valuation discount. The property would be valued at US$600,000 (instead of US$750,000) for US estate tax valuation for each of their respective CBTs.

The IRS bases its determination of estate tax due on an asset’s fair market value. Fair market value is defined as the price at which the asset would change hands between a willing buyer and a willing seller, neither being under compulsion to buy or sell. Fair market value is often a gray area, leaving the worth of the asset and the resulting tax due open to dispute.

Valuation discounts may substantially decrease the value of an asset and therefore lower the tax. They apply to real estate and businesses depending on how title is held. If Brad tries to sell his 50% interest on the open market, he may not be able to find a buyer because buyers rarely want to own something over which they have no control. For example, if the buyer subsequently wanted to sell the property, Angelina, who holds the remaining 50%, may not be interested.

Since Brad may have a hard time finding such a buyer, the marketplace would offer substantially less than the 50% pro-rata share of the total value. So why should Brad’s estate (or Angelina’s if she dies first) pay estate tax on the full 50%? Therefore, the valuation discounts quantify the difference between the pro-rata share of the asset (in this case 50% of approximately US$1.5 million) and the value of the precise interest owned.

Based on our experience and research conducted on the matter, valuation discounts accepted by the IRS where title is restructured into two separate CBTs are between 20% and 33%. Being conservative, we use the 20% mark.

Therefore, with the described valuation discounts, and where title is restructured as hereafter proposed into two separate CBTs, Brad’s estimated taxable estate for US estate tax purposes may be reduced to US$600,000 (US$750,000 minus 20%) based on a worldwide estate of US$6.5 million (for simplicity purposes, the available discount has not been reflected in the denominator) if he dies first, resulting in US estate taxes estimated at US$58,418 if he passes away in 2009. Should Angelina survive Brad, a marital credit is applicable under the code, and thus Brad’s estate will not owe any tax (see “If Brad dies first,” above). Note that the marital credit doubles up the unified credit.

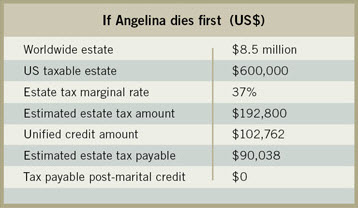

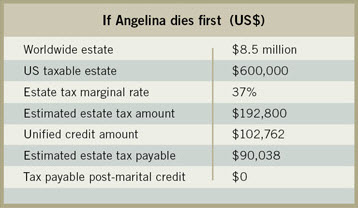

If Angelina dies first, after splitting the property into the two CBTs and taking the valuation discounts, her estate would have tax of $90,038. However, with the marital credit, there would be no tax (see “If Angelina dies first,” below left).

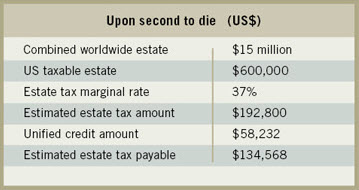

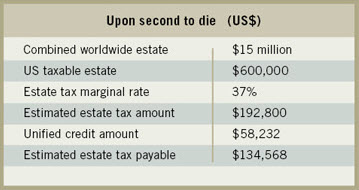

Upon second to die, however, the estate tax is still problematic as US$134,568 is owed (see table above).

Florida nonrecourse mortgage

NRM is a useful estate planning structure to decrease the value of the US taxable estate. It creates a dollar-for-dollar reduction on the US taxable estate upon death. A standard mortgage does not give the estate a dollar-for-dollar deduction for a nonresident. RBC Bank in the US offers this product to Canadian residents.

As described above, we would expect the IRS to allow a 20% discount of the value of the property where title is held by the two CBTs. The discounted value of the property would be US$1.2 million for US estate tax valuation purposes.

If the couple obtained an NRM from a US bank at a rate of 60% loan to value (which is their maximum LTV ratio), in the amount of US$900,000 on the US$1.5-million property, the total valuation of the US property would be US$150,000 for estate tax purposes for each spouse (after applying the valuation discount in the two CBTs).

Each spouse would pay 50% of the purchase price from separate bank accounts. The CBT of each spouse would be deemed to own half of the value of the property. After creating the CBT, applying the discount value and obtaining an NRM from the bank as a refinance after the purchase, there will only be minimal estate tax exposure. Since each CBT will hold title to 50% of the property with 50% of the NRM debt, each spouse’s interests in the property would be valued at US$150,000 for US estate tax purposes (US$1.5 million x 20% discount divided by 2, minus 50% of US$900,000 NRM).

Thus, should the couple die in 2009, the estate would have US$24,242 US estate tax liability as opposed to the aforementioned US$134,568.

Interest deductibility rule

If they have the available liquidity, it is preferable to pay all cash for the entire purchase price and to then refinance after closing. The resulting loan proceeds are used to fund the purchase of an investment portfolio in Canada. Thereby, they are able to deduct the interest on a US mortgage from the revenue generated by loan proceeds in a Canadian portfolio

Worldwide estate value issue

The larger the worldwide estate value, the lower the unified credit available under the treaty and therefore the higher the estate tax. In other words, if Angelina dies first and leaves her US$8.5-million estate to Brad, his worldwide estate upon his subsequent death would be US$15 million with a tax of US$24,242 even with the above estate plan in place.

Canadian crossborder spousal trusts in Ontario wills

Canadian crossborder spousal trusts in Ontario wills

To avoid the value of the estate of the second to die being $15 million, amendments to Brad and Angelina’s Canadian wills should be implemented. Each spouse should bequest his/her estate to the other spouse by testamentary crossborder spousal trusts in their respective Canadian Last Will and Testament. From the IRS perspective, the value in such spousal trust (i.e. Angelina’s estate value of US$8.5 million left to Brad in her will, as revised), won’t be considered part of his estate on his subsequent death. Therefore, his worldwide estate would be US$6.5 million on death, not US$15 million and the US estate tax would be US$5,205 instead of US$24,242. There are also Canadian estate planning advantages for spousal trusts. For Angelina’s estate as second to die, her worldwide estate will remain at US$8.5 million with tax of US$13,109 instead of US$24,242.

Private nonrecourse Florida mortgage

To completely avoid US estate tax on death of both first and second spouse, the couple could arrange a second, private US NRM in the amount of US$200,000 on the property. The US$200,000 loan proceeds are invested in their investment portfolio. The property would be valued at US$100,000 for US estate tax purposes. This value is divided in half, since the separate CBTs would each own half the property. Thus, for US estate tax purposes, each estate would be valued at US$50,000.

Should the couple pass away in 2009, each estate would be liable for $0 US estate taxes on first to die and US$102 of tax on second to die. The advantage of the NRM is an elimination of US estate taxes upon death.

Alternative estate planning structures

The following are alternative estate plans that present certain problems and are generally considered more aggressive and may have a higher risk of IRS audit. They include: Canadian corporation; Canadian limited partnership; Canadian family discretionary trust; and Florida limited liability corporation. The objective of such alternative estate plans is to avoid US estate tax.

Some of the issues with these strategies include:

- higher capital gains tax rate for a Canadian corporation: IRS rate of 34% plus Florida Department of Revenue tax of 5.5%. In the CBT, the IRS rate is 15% for a long-term holding (i.e. more than 12 months). Florida does not tax the gain where title is held by the CBT;

- there is also the shareholder benefit rule with the Canadian corporation that could cause the shareholder who uses the property for personal use to be forced to add the value of the usage to his or her Canadian income;

- US banks generally do not provide mortgage loans to these structures;

- IRS position of looking through these structures for US estate tax purposes and taxing as if individually owned;

- in the Canadian family discretionary trust structure, there is an issue with the 21-year disposition rule;

- note that if the individual had already owned the US property and it had appreciated in value, transferring title to such legal entities would be considered by the CRA as a deemed disposition. This means that an immediate Canadian capital gain tax would be triggered on the gain. However, capital gain taxation may be delayed using rollover provisions in Canadian Tax legislation where applicable;

- where the individual already owns the property and transfers it to either a Canadian family discretionary trust or limited partnership and continues to use the property, the IRS may apply the retained interest rule and look through such entity and tax the individual upon death;

- expensive legal fees to set up some of these structures as well as annual filing requirements.

Conclusion

Planning to avoid US estate tax and probate issues for Canadians depends on the facts of the particular case. The foregoing example applies sophisticated, but conservative, tax and estate planning strategies that we have applied in client situations. Upon death after the implementations, probate procedures were successfully avoided and IRS Estate Tax Clearance Certificates were obtained with no estate tax payable. Although some aspects can be implemented at the time of first death, establishing and documenting the appropriate structure at the time of purchase is critical to achieving the tax minimization objective.

(The issues and solutions discussed apply to all states where Canadians typically own a vacation home, including Florida, Arizona, California, Hawaii, etc.)

![]()

![]()

![]()

Download the article here (PDF).

Technical editor: Garnet Anderson, CA, CFA, vice-president and portfolio manager, Tacita Capital Inc. in Toronto